Executive Summary

Ric Traynor, the current Executive Chairman founded Traynor & Co in 1989 which, following the acquisition of Begbies London in 1997, became Begbies Traynor and finally listed on the AIM exchange in October 2004. Today it is the leading provider of insolvency services in the UK.

It offers predominately Business Recovery services including assistance with the various avenues of liquidation and bankruptcy for both corporates and individuals. In addition to this the group also provides asset valuations, corporate finance, transactional services, financial advisory and property consultation, which all synergise well with their core services in insolvency.

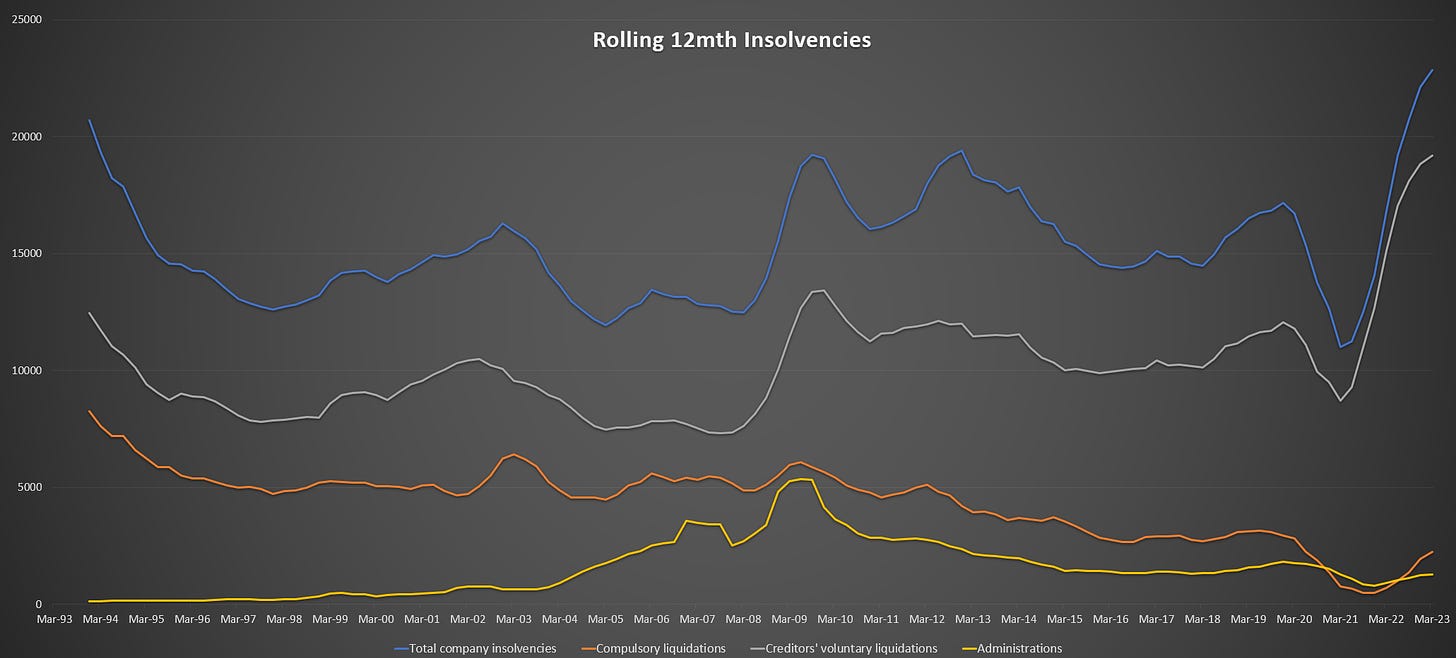

Corporate Insolvencies are higher than they have been in the past decade, but many more businesses as a % of the total are choosing creditors voluntary liquidation as an option as opposed to Compulsory liquidations or Administrations which are typically more complex and higher per job revenue contributors, indicating perhaps that larger businesses aren’t seeing the stress of SME’s.

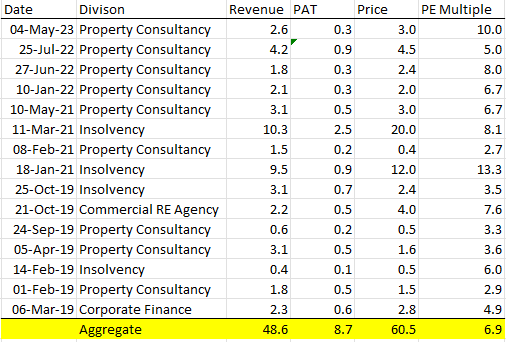

Management is highly adept at acquisitions, with the average upfront PE of 6.9x paid for it’s businesses, with a material focus on deferred compensation and stretch targets.

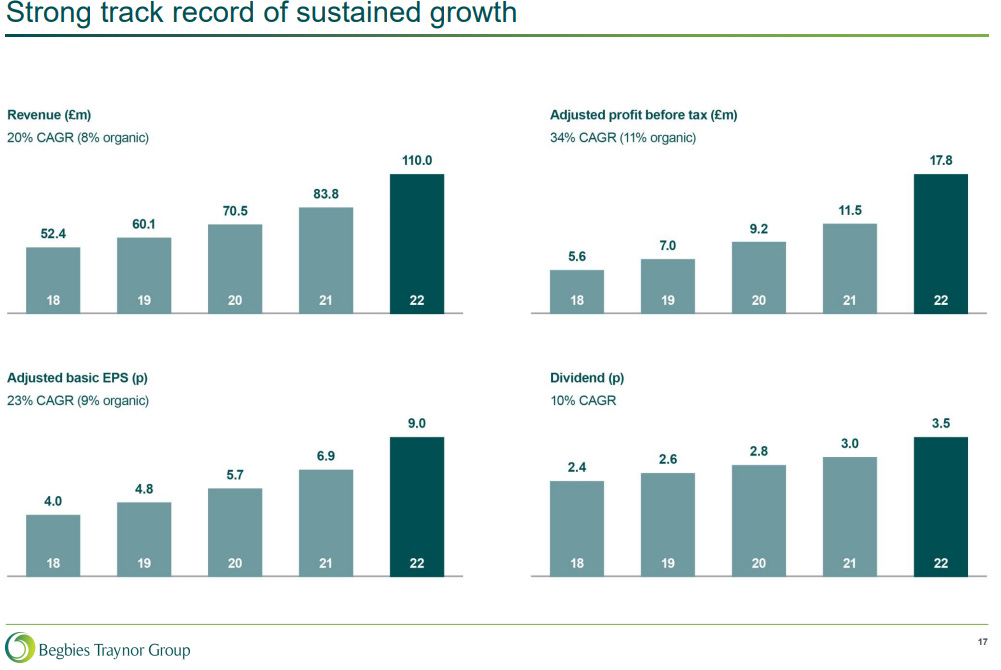

Begbies trades at £1.36 (5 July 2023) and is expected to generate a FY23 EPS of £0.10. Of this, it is expected that Begbies will pay a full year dividend of £0.04. Given the past 5 years the group has compounded it’s EPS at a CAGR of 23% p.a. It trades at a 5Y trailing PEGY of ~0.5x.

Key Definitions

Liquidation

Liquidation is a legal process in which a liquidator is appointed to ‘wind up’ the affairs of a limited company. The purpose of liquidation is to sell the company’s assets and distribute the proceeds to its creditors. At the end of the process, the company is dissolved – it ceases to exist.

Compulsory liquidation

A winding-up order obtained from the court by a creditor, shareholder or director. See Liquidation for details on the process.

Creditors’ Voluntary Liquidation (CVL)

Shareholders of a company can themselves pass a resolution that the company be wound up voluntarily. See Liquidation for details on the process.

Administration

The objective of administration is the rescue of the company as a going concern, or if this is not possible then to obtain a better result for creditors than would be likely if the company were to be wound up. A licensed insolvency practitioner, ‘the administrator’, is appointed to manage a company’s affairs, business and property for the benefit of the creditors.

Moratorium

Moratoriums were introduced under the Corporate Insolvency and Governance Act 2020 to give struggling businesses formal breathing space in which to explore rescue and restructuring options, free from creditor or other legal action. Except in certain circumstances, no insolvency proceedings can be instigated against the company during the moratorium period. It also prevents legal action being taken against a company without permission from the court.

Receivership Appointment

Administrative receivership is where a creditor with a floating charge (often a bank) appoints a licensed insolvency practitioner to recover the money it is owed. Before 2000, receivership appointments also included other, non-insolvency, procedures, for example under the Law of Property Act 1925

Restructuring Plan

New restructuring measures were introduced under the Corporate Insolvency and Governance Act 2020 to support viable companies struggling with unmanageable debt obligations to restructure under a new procedure. They allow the court to sanction a plan that binds creditors to a restructuring plan if it is fair and equitable. Creditors vote on the plan, but the court can impose it on dissenting classes of creditors (‘cram down’) provided that the necessary conditions are met.

Company Brief

Source: 1H23 Results Presentation

Ric Traynor, the current Executive Chairman founded Traynor & Co in 1989 which, following the acquisition of Begbies London in 1997, became Begbies Traynor and finally listed on the AIM exchange in October 2004. From the issuance price of 40p it has provided shareholders with an annualised return of 13% p.a. (with dividends reinvested) to date relative to the FTSE All Share index which provided an annualised return of 11% p.a. EPS (exc. acquisition accounting) grew from 5.1p to 9.6p (4% p.a.) and the business paid 43p in dividends. (5% p.a.) leaving a remaining 4% attributable to multiple expansion.

Major shareholders include Ric Traynor at 17.5% of the company and a swathe of institutional owners. However, given the apparent lack of depth in their thesis as shown here and here I do not particularly trust their judgement or their future decision to purchase or sell any of their holding.

Trading volume is adequate with 37% of the shares having turned over in the past 12 months, or £57m at current prices. When converted this means the company trades an average of £226k per day.

With over 800 Fee earners and ~160 support staff, this business is by no means small (you may recall DSW Capital has 88 Fee earners and 16 support staff), and in recovery saturates the UK market already with a 14% market share in all corporate insolvency appointments. Other services include property and advisory to a lesser degree with services in corporate finance, brokering and business valuations/sales. Lastly there is some uncorrelated activities in forensic accounting and pension advisory.

For the purpose of this write up, I will be focusing predominately on their Insolvency business, which accounts for 72% and 80% of their revenue and Profit respectively. I believe given the cross-sell potential that flows into their insolvency business drives referral into the rest of their businesses as that is what they are known for.

A Perfect Storm

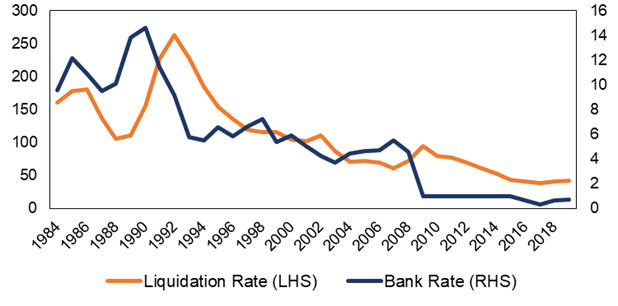

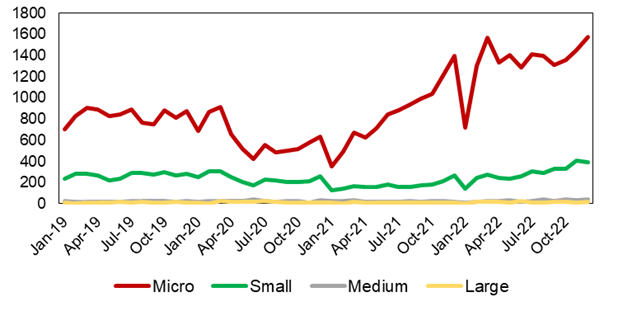

Firstly, we can establish that Insolvencies are largely tied to the availability and the cost of money supply, ie. when debt is cheap and asset valuations are high, insolvencies should be at their lowest, which is in part demonstrated by the chart above. With the reversal in interest rates, corporate stress s more apparent.

Source: Quarterly & Monthly Statistics 1994-2023 - The Insolvency Service

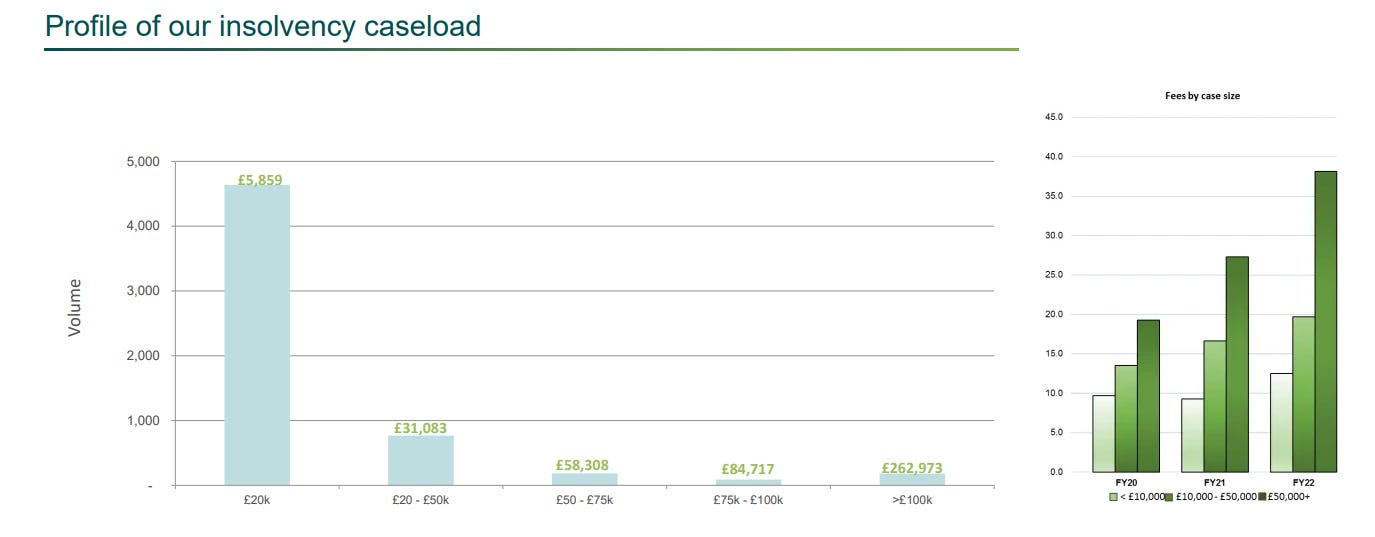

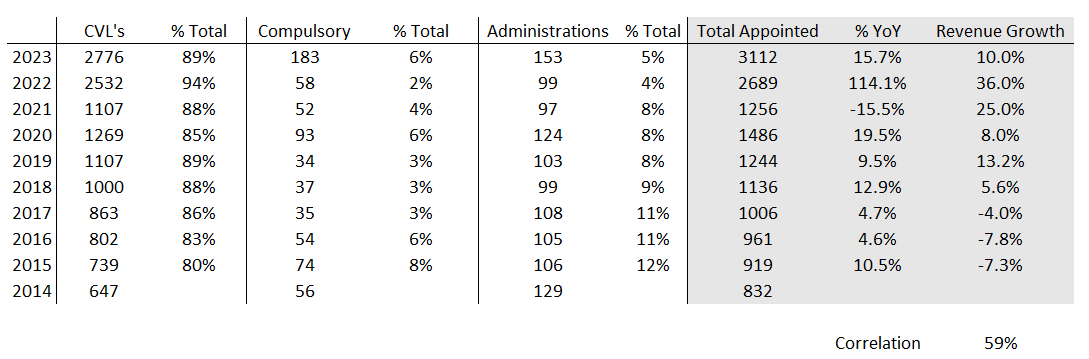

The average CVL charges c. 4.5k and Begbies would have prepared c. 2800 of these in the 12m leading up to 1H23. in contrast they state they have c. 10% of the administration market or 92 appointments in the trailing 12m leading up to 1H23.

Source: FY22 & FY18 Results Presentations

As can be seen above, many of the Begbies cases land beyond the 50k mark, and some large-scale cases even land in the hundreds of thousands, notably these are typically not CVL’s but administrations and compulsory liquidations, 2 areas where we have seen cyclically weak activity over the past few years (yellow and orange lines in chart above) with an expected uptick in the next few.

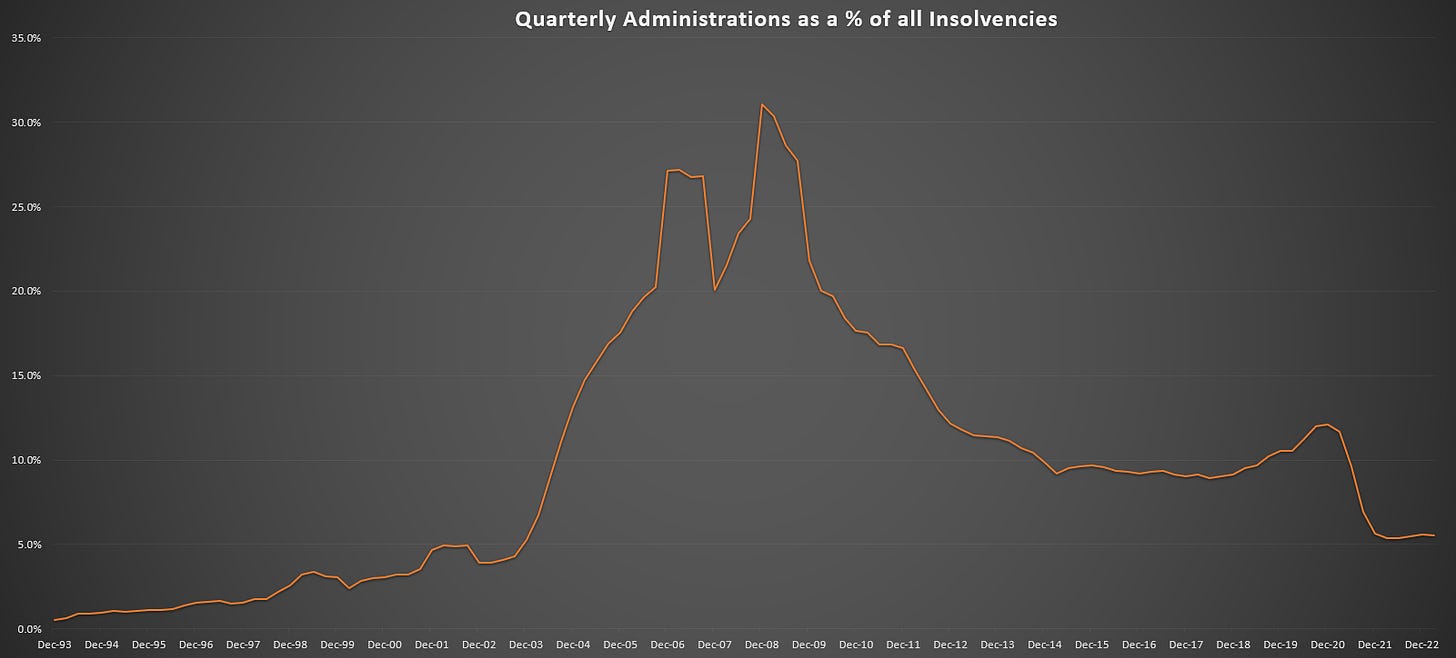

During the 2008 GFC administrations peaked at ~30% of all appointments, whereas right now it is ~6%. This figure also helps explain why there was not a rapid decline of revenue in 2020 with an abundance of support for SME’s. Mid-market entities didn’t have the same level of support and administrations strengthened to ~12% of all appointments.

With alternative avenues for companies in distress, It is crucial to beg the question if Compulsory liquidations and administrations will ever get the demand, they saw back in the late 2000s. I don’t have a good answer for this besides that it appears in times of significant corporate distress however there are some good reasons for the relative slowdown in numbers in the past 2 years.

The primary reason appears to be the introduction of the COVID-19 loan scheme to predominately small and micro sized businesses in March 2020 through to March 2021, which you can see the drop and subsequent rise in insolvencies (blue line in the first chart above) correlate. close to 60% of all insolvencies between May 2020 and March 2022 were incurred by firms who had also taken out a Bounce Back Loan.

This was replaced in April 2021 by the Recovery Loan Scheme, but this appears to be on track with minor arrears.

Sources: Insolvency Service, Gazette and Bureau van Dijk.

This is further supported with the chart above showing that Micro firms drive the recent drive-in numbers. In 2022, 81% of insolvencies comprised micro firms, compared to 73% in 2019. This uptick can in part be attributed to timing. The insolvency process tends to be more drawn out for large firms, so it will take longer for the impact of Covid, and the energy price rises to be reflected in the statistics.

However, this overrepresentation to micro-sized businesses can change as macroeconomic challenges continue to accumulate, government loan payments become due, financial conditions tighten, and larger, more complex insolvencies start to crystallise.

Lastly, there is an excellent website called The Gazette which is a real-time timeline of insolvency notices. Pro-tip, if you type ‘Begbies’ in the text search you will see all notices involving Begbies (And yes, for those interested searching for Dow Schofield Watts reveals notices for their business recovery team). Sorting this by Appointments in the various categories shown above we get the below data. Appointments broadly speaking should be a strong leading indicator for the group’s order book given it is after pre-appointment fixed fees but prior to the real meat of post-appointment remuneration.

My goal here was to find a correlating dataset of leading indicators. With 59% correlation I can be reasonably confident of its nexus to potential future revenue growth, but still am trying to look for something a bit more certain.

After testing some of the other options out, I found same year appointments to have the strongest predictive power. Notably, everything is positively correlated which should be obvious. Some takeaways from this analysis are:

Appointments as a whole were more predictive than just using all notices on the register. This makes sense as appointments are non-routine and deliberate actions that are directly tied to revenue potential, whereas other notices could simply be routine requirements as part of the insolvency process which may not necessarily be billable.

Excluding the Creditor’s Voluntary liquidation appointments from all appointments had a huge impact on predictive power, which is not particularly surprising as whilst these are low value appointments, they typically account for 80%+ of all appointments, and therefore smooth the average fee for each case. Smoothing the price variability should further correlate the volume of appointments with the revenue realised.

Another thing which was surprising to me was that correlation typically went down in all cases, except for non CVL appointments, which more than doubled it’s correlation. This is also quite satisfactory, as these are all the appointments which are more complex and are typically longer dated.

Dividend Notices I thought would have a strong correlation to booked revenue, as it reflects payments to creditors, including the insolvency practitioner. This was mildly predictive but perhaps the explanation for this is that fees are booked throughout the case as assets are realised. Dividends are in my experience paid out after all other assets have been realised. Furthermore, it ignores the risk that there could just be no dividends as shareholders are at the bottom of the capital stack.

How do the Financials work?

The first question you might ask yourself here is how does an insolvency practitioner get paid by business operating as a going concern? Statutory insolvency hierarchy sets out the order in which creditors are to be paid. Each class of creditor must be paid in full before the next class can be paid. Creditors will rank in the following order of priority:

fixed charge creditors

priority pre-moratorium debts and moratorium debts

expenses of the insolvency (Practitioners fees)

preferential creditors

the prescribed part for unsecured creditors

floating charge debts

unsecured creditors

statutory interest on debts

shareholders

In all cases, an insolvency practitioner’s fees are paid in one of two ways, or a combination thereof throughout the proceeding:

Fixed fees: insolvency practitioners are paid for the time spent providing services. This can be a fixed hourly fee or a fixed fee for the entire project.

Percentage fees: insolvency practitioners can be paid a percentage value of the company entering insolvency or a percentage value of the assets and gains that are realised through liquidation.

Furthermore, Insolvency practitioners are paid before, during and after the matter. Typically, Insolvency practitioners have to be appointed by creditors. There is pre-appointment work that is typically paid as a fixed or hourly rate, and the appointed work which can be paid post-appointment, either as the same or as a % of realised assets to account for the risk they took on. Insolvency proceedings last 12 months in the majority of cases, and the insolvency practitioner can be paid at the end, on a monthly basis, or as and when funds become available.

The corporate finance and broking service line recognises its revenue at a point in time. Typically, when a transaction is completed a fixed % of the value is invoiced to the client being advised.

The group also has a subsidiary which operates as a commercial property manager with the majority of customers billed quarterly in advance, providing a source of deferred income to the group… a desirable trait which improves capital turns. Property consultancy services including valuation etc. are booked at a point in time.

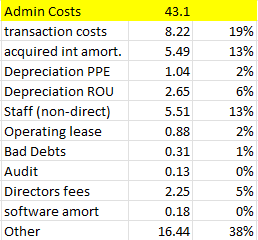

The groups cost base as you would gather is predominately labour with a noticeable lack of detail for administrative expenses, with only 62% of it identifiable per the notes to the financial statements.

This by itself is enough for me to pause and think about what happened with similar opaqueness in the cost structure of AF legal, which I had a number of key lessons noted in my 2022 review. By itself, given the long history of dividend payments and unqualified audit opinions by Big 4 and large mid-tier auditors with reasonable materiality of ~£0.5m average in the past 5 years.

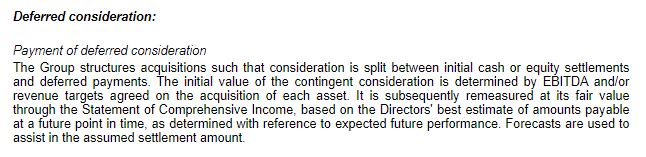

You will note transaction costs and acquired intangibles as accounting for ~32% of administrative costs, and ~12% of revenue. These pertain to acquisition related costs in the same economic reality as goodwill, but instead is accounted for using IFRS3. Under the treatment of deferred consideration per IFRS 3, in circumstances where the payment of deferred consideration is contingent on the seller remaining within the employment of the Group during the deferred period, the contingent portion of deferred consideration is treated as remuneration and accounted for as a charge against profits. Henceforth this is all legitimate uses of free cash flow of the business.

The balance sheet primarily consists of client debtors, staff accruals, term debt and goodwill. It is not particularly important alone, as it is a reflection of the information above. However, with the existence of the balance sheet, we can determine the degree of which the business requires capital in its ordinary course of business.

In the past decade we have seen revenues more than double on almost flat debtors. The accruals have gone in the normal direction you would expect with COGS up more than 2-fold as well when you back out the exception of current liabilities pertaining to the new commercial property management deferred revenue and lease liabilities accounting change. The contributing factors towards this are the addition of the property division, which is all transactional or negative working capital, and the increased proportion of CVL’s in the insolvency workload, which would typically be shorter term jobs with less WIP carry.

Future Growth Potential

Of course, besides the obvious potential wave of higher value cases to drive organic growth, there is also other factors such as the potential for future acquisitions or margin expansion.

Staying on the existing business first, Ric Traynor is on notice for having informed the market that they have ~20% headcount capacity to take on additional workload. Given the potential further rapid rise in appointments, particularly in higher value more complex appointments, it’s going to be difficult to resource quick enough to maintain that excess capacity. The benefit of this is that in the time that they are closer to full capacity, the group should see a very material benefit to the bottom line. My own estimates on what this could look like are shown below.

What this 20%+ capacity allows is an incremental 100% margin rather than more volume at the group’s typical 40-50% gross profit margin. In terms of revenue, I see ~£5m of revenue capacity, but if this all dropped down to the bottom line. With an EV of about 210m, this would bring the group to an EV/EBIT of ~6x and a PE ratio of 8x on a stable revenue base.

Acquisitions historically have been done at excellent multiples, contributing 14% to the 5y EPS growth CAGR of 23%. This has been funded ~50% from new equity, 43% from retained earnings and ~7% from working capital. Given a ~40% payout of PAT this would approximate a 14%/60% = 23% return on that investment which implies that roughly 1/3 of that came from synergies and 2/3 from the acquired earnings.

With the potentially strong organic growth in the future and excellent historical capital allocation, Begbies at a multiple of 13x FY23E earnings seems undemanding when you factor in the growth history of the business, with 23% 5y EPS CAGR and 3% dividend yield this would equate to a PEGY of 0.5x. I do not see this weakening in the future, but rather due to the cyclical upswing in higher value appointments and capacity in the headcount, I see strong revenue growth and even stronger earnings growth in Begbies Future.

I hope you enjoyed this write up, Thank you for reading.

Kind regards

Tristan

This is a really good post, Tristan! I've been an investor in Begbies for over 3 years now, and you've given me some food for thought and insight that is new. Especially the part about getting early leading indicators. FWIW I think there are many jaded investors here who have been waiting for the Insolvency market to explode. Yes, it has trended up nicely YoY for Begbies, but no explosive growth yet. Will 2024 bring that? Hard to see why not given cost of capital is now high and companies are facing rising costs of debt while inflation has also increased input costs. Time will tell... (I hold in the Boon Fund)

Thanks for this writeup. Would you consider Burford Capital ltd within your circle of competence? I just started to look into it and would appreciate your expertise.