Elixirr is an international consulting firm founded by Stephen Newton (CEO) & Graham Busby (CFO), with the intention to grow into a global consultancy firm to rival the likes of Accenture, IBM, Mckinsey and the like.

Consulting itself, is a fairly opaque profession where it is not very apparent what they actually do. But the way I view this is anything advice related that doesn’t fall into the confines of other areas, and henceforth is granted full autonomy into how they operate. Typically a consultant is highly skilled in specific areas and have some sort of ‘knowledge advantage’ over their clientele. Common areas include assisting c-suite level executives with Strategy, management, operations, finance, IT and HR. But these in and of themselves again still have high levels of opacity into what consultants do.

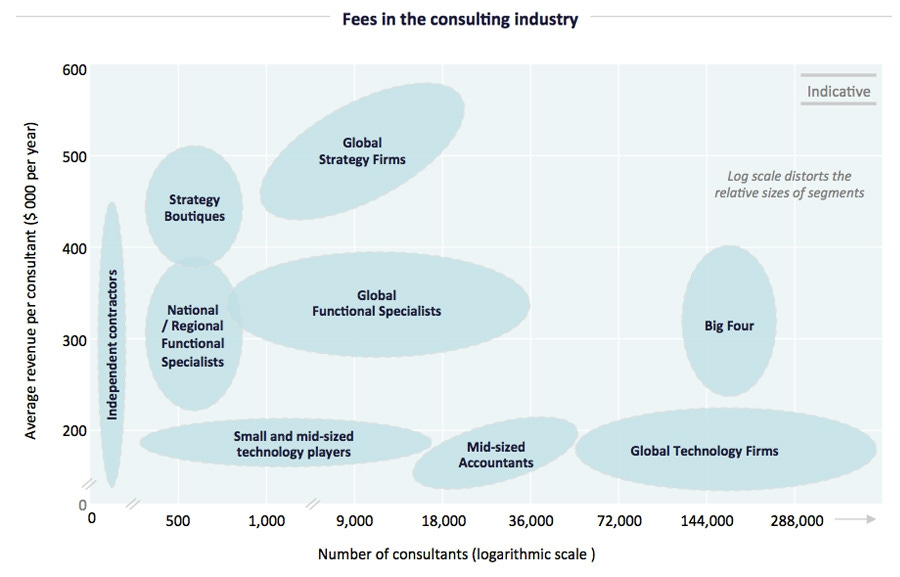

Because these services are hard to quantify, consultants historically have had incredibly high levels of revenue on a per consultant level. The average consultant under Elixirr for example bills in excess £3.1m per year ($5.7m AUD). This compares in stark contrast to the average partner under Kelly+Partners for example billing £0.6m ($1.1m AUD) and DSW Capital Partners billing £0.5m per year ($0.9m AUD) for example which are both in the low/mid tier accounting space where the industry is more competitive, fragmented and lower fee where cost leadership goes a long way.

Perhaps what many will find interesting is that Elixirr offers a way for all it’s employees to earn equity and offers to match it 100% over a 5-year vesting period. For Junior level consultants they allow 10% of their salary into this scheme and managers up to 20%. They say this compares favourably to other firms where that scheme is normally 10% flat and a 3:1 matching ratio. This of course is going to be fairly dilutive, given that salaries are the primary cost of all professional services firms. Should this equate to an average of say ~10-15% per year, this would equate to ~5-8% dilution each year from the impact of the share scheme alone given wages currently account for slightly over 50% of revenue. Team ownership is detailed below.

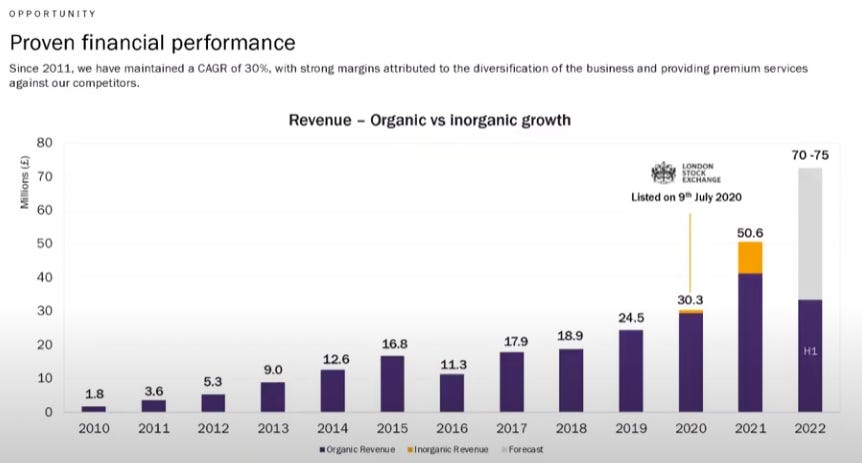

Shifting over the historical financials, the growth profile of the business is astonishing from inception to date, with a 30% CAGR, which was achieved by virtually all organic means as shown below.

Speaking from a cost base perspective the group has impressive margins with current NPAT margins amounting to 20% with high cash conversion. However, we have not much detail into underlying profitability historically due to the business operating under a private partnership model previously where owners were trading wages in lieu for partner drawings, making it difficult to normalise their wages to a reasonable level.

Given the business currently trades on a EV/Sales multiple of ~3x 2022 revenue, and the normalised cash flow margins of 20-25%, the group trades on a low teens multiple of cash flow. Given their track record of 30% p.a. organic growth and 58% compounded growth since the IPO in 2020, less the dilution required to get there from the employee benefit schemes. The group trades on atleast below 0.5x PEGY on a midpoint, although given the pie in the sky numbers, it’s difficult to say exactly HOW cheap Elixirr is. Personally, consulting is a bit of a fluff industry for me so I don’t have huge confidence in this as a practice, although it is without a doubt highly profitable for all involved in providing the service, and I like the team ownership and management team from the small amount i’ve seen thus far.

Thank you for reading, please consider subscribing to my paid service, as next week going into April I will be releasing my first Deep dive of the year on Prime Financial Group (ASX:PFG), an ASX listed Accounting and Wealth management business, operating in areas where I have personal experience in as an tax compliance and business advisory accountant and prior experience in wealth, lastly with credentials covering both.

Regards

Tristan.

Well yes, I am old school both by age and approach, I guess. Sticky recurring income is as I remembered it back in private practice 40 years ago was the traditional client who returned year in year out for accounting and tax work. The annual revenue formed the basis of what the goodwill/selling price of the practice might be as it was a multiple of that. Special assignment work such as a once off acting as investigative accountant in a public listing was not included.

I recollect back then, I could roughly ascertain profits weekly by knowing just three figures (a) gross revenue from timesheets from which I deducted 5% (b) gross wages to which I added 20% for on costs and (c) my pre worked out weekly costs of ‘doing business’. It was amazingly accurate.

I am specifically interested in the professional businesses because of the ease of business model and the protection from macro events. In tough times you don’t buy that diamond ring but you reluctantly get your tax done because it is a compulsory obligation.

My only concerns are change of law reducing that obligation, impact of AI (look at how it has hollowed out property valuers and say, surveyors - and - as you have alluded to in Australian Family Law, greed in rewarding directors for their wages content.

Interesting concept and a brilliant track record. Almost unbeatable for those on the inside, maybe not so for the run of mill investor because of the (a) lack of recurring revenue and over reliance on large one off projects (b) lack of transparency via off Balance partnerships and (c) persistent & significant dilution.

Might I assume that a 20% NPAT/REVENUE is the ultimate dream for the average professional consultancy firm. What then is deemed average?