Sequoia Financial Group (ASX:SEQ) - Deep Dive

Australian Diversified Financial Services Business

Executive Summary

A profitable financial conglomerate providing a variety of professional and financial services to Australian accountants and finance professionals. More specifically across financial advice, accounting outsourcing, Professional indemnity insurance, legal documents, financial products, corporate finance and financial news.

Management is highly incentivised with the CEO Garry Crole owning 8.1% of the company and all the directors accounting for 11.4% ownership.

Most of its subsidiaries are neutral or negative in their working capital cycle, leading to a favorable conversion of profits to cash.

Since the Reverse takeover of Sequoia in 2015, EPS compounded from 0.59c in 2016 to 4.23c in 2022 or +39% p.a. In contrast to this the group has provided a +9.7% p.a. return to shareholders (including dividends) since the reverse takeover.

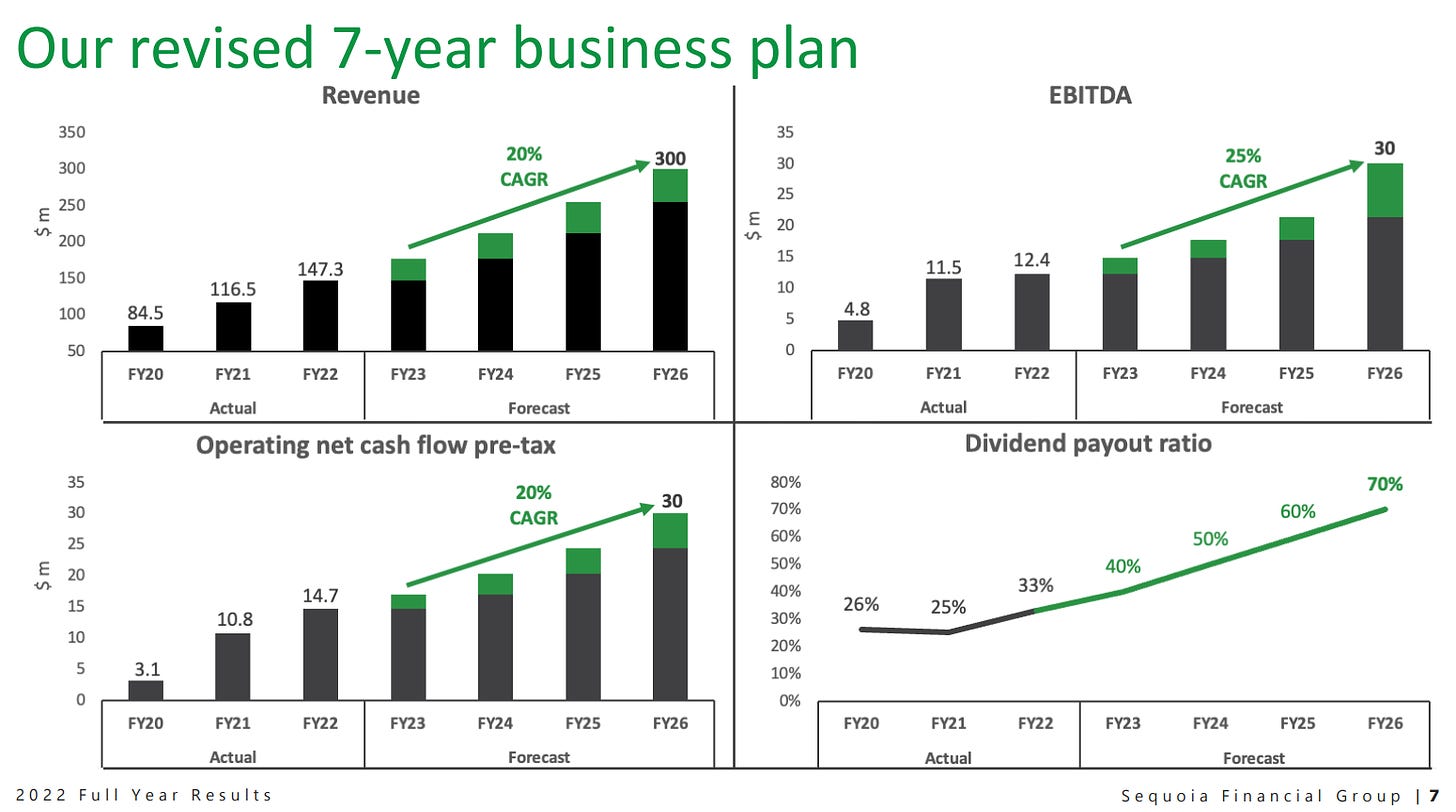

With the sale of its Morrison Securities Clearing Business, the group trades at an estimated ~4-5x EV/EBITDA, despite the aspiration to grow profits >20% p.a. in the coming 4 years, whilst moving to a majority payout ratio with fully franked dividends.

Company Brief

Sequoia Financial Group (henceforth referred to as ‘Sequoia’) is an integrated financial services company providing products and services to self-directed retail and wholesale clients and those of third-party professional service firms. It is a highly diverse financial conglomerate of sorts which is best viewed upon as a sum of its individual parts. For this reason, I have decided to tackle this by viewing it in the lends of the parent entity subsidiaries which are structured as shown below:

I don’t hold much stock in which entities fall under which holding company, as it seems fairly inconsistent in its current form. For example, Interprac General Insurance is an Accounting PI Insurance broker, but it lies under Docscentre. Similarly Australian Practical Superannuation Fund Pty Ltd is an APRA super fund but also lies under Docscentre. For this reason, we will primarily be looking into each of the underlying subsidiaries (Blue boxes above). It will not be a conventional write up but a true deep dive into the business understanding each subsidiary for a holistic full picture.

Sequoia Family Office (SFO)

This business was launched at the beginning of July 2021, post the acquisition of Macro Investment Advisory Pty Ltd for $600k. This acquisition brought across Sophie Chen, the AFSL Responsible Manager of Macro Capital at the time.

At the time of acquisition SFO was expected to generate $200k in EBITDA in the first year and they were targeting to grow funds under advice to $2 billion over the next five years.

Unfortunately, this particular part of the business is not covered a whole lot but the 3 employees it has have extensive descriptions on LinkedIn about their roles. Junwen Xia (Allen), CPA, CMA is a Corporate Development Director based out of Hong Kong and has provided the following blurb about his role:

Whilst the SFO business is opaque, it’s size is minor relative to the group. I look forward to seeing future developments as the FUA goal would lead to a material contribution to the group.

Sequoia Asset Management (SAM)

SAM holds an AFSL and provides general advice on a range of investment areas including model portfolios, capital raises, IPOs, structured investments and more. Importantly, it is specifically set up to provide only general advice in relation to any of these, and even provides a service called ‘Invest Assist’ which is designed to give preferential treatment to monthly subscribers such as exclusive first access to investment opportunities, a dedicated account manager to point you in the right direction, regular commentary and even document certification. In my own view, this service is entirely unnecessary although knowing many SMSF owners myself, I can see why people would use something like this.

Sequoia Specialist Investments (SSI)

Speaking of those investment opportunities, SSI is responsible for providing unique investment opportunities and has been issuing these to retail and wholesale investors since 2010, having a total notional value of $400m over this timeframe. To note, SAM is the ultimate lead distributor of these offerings, as SSI does not have its own AFSL.

Within these opportunities there is an interesting offering called a structured investment which are an attractive package for SMSF’s which have restricted lending flexibility. These products enable leverage with limited recourse to be provided to an SMSF, which also carries no margin calls. This is enabled through the use of a Deferred Purchase Agreement (DPA), the same legal structure used for some of the popular Citi warrants. The DPA is funded via. a LRBA with the SMSF which allows the SMSF to access 100% gearing and fixed interest rates, albeit the interest is paid upfront. The maximum loss is limited via. the ‘limited recourse’ part of the loan to just the value of the DPA units held, prepaid interest and any applicable fees. Importantly in the event you need to realise the investment sooner than the term, you don’t receive a refund of interest. Lastly, the underlying exposure is achieved through the use of derivatives rather than a direct investment, which is held by Sequoia Nominees as custodian, meaning that if sequoia were to fail, these assets would be worthless.

The use of these products is an area of focus for the ATO as they arise a number of important tax issues that can be construed as anti-avoidance should the issuer not carefully construct the product so as to avoid these provisions. Furthermore, due to its high level of complexity, these products are not suitable for the vast majority of people. For more information, this article is useful coverage on some of the negative ramifications of DPAs.

In saying this, commencing in October 2021, ASIC issued the Design and Distribution Obligations (DDO) regime, requiring distributers of financial products to prepare a target market determination (TMD) in order to protect retail investors (Does not apply to wholesale investors). In short, the new regulation requires that product issuers design financial products that are consistent with the likely objectives, financial situation and needs of the consumers for whom they are intended (the target market), and take reasonable steps to ensure investors outside the target market are unlikely to acquire a product.

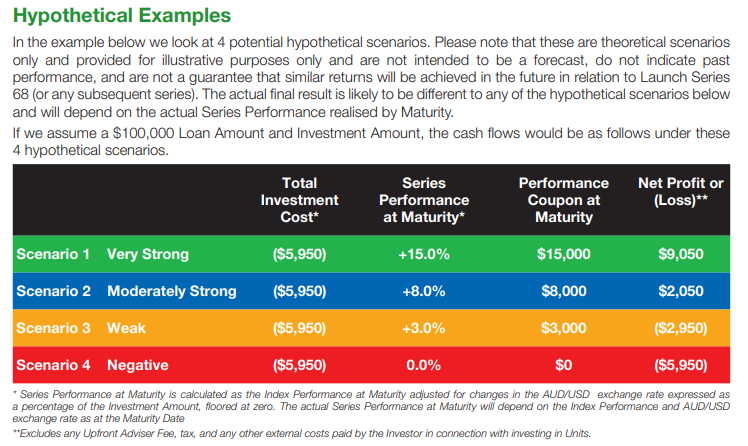

The fact that SSI is still offering DPA’s in light of this, means that the TMD has passed the ASIC sniff test. For an example of what an SSI TMD may look like, refer to this recent April 2023 TMD for the Sequoia Launch Series 68 (SL68). I note that the fees for a $100,000 investment into SL68 would equate to $5,950 (made up of $650 application fee and $5,300 prepaid interest) with a 2.65% p.a. fixed interest rate given it’s 2-year term. The benefit of which is that the interest is non-compounding as it is paid up front. A hypothetical example is provided within the product flyer clearly showing potential outcomes including fees and interest.

In light of all of the above, SSI in my belief has its place in an adviser’s toolset (for wholesale investors) and even for some retail investors given its highly attractive fixed interest and limited recourse gearing, which is probably still preferable to margin loans given its non-callable nature.

Sequoia Direct (SD)

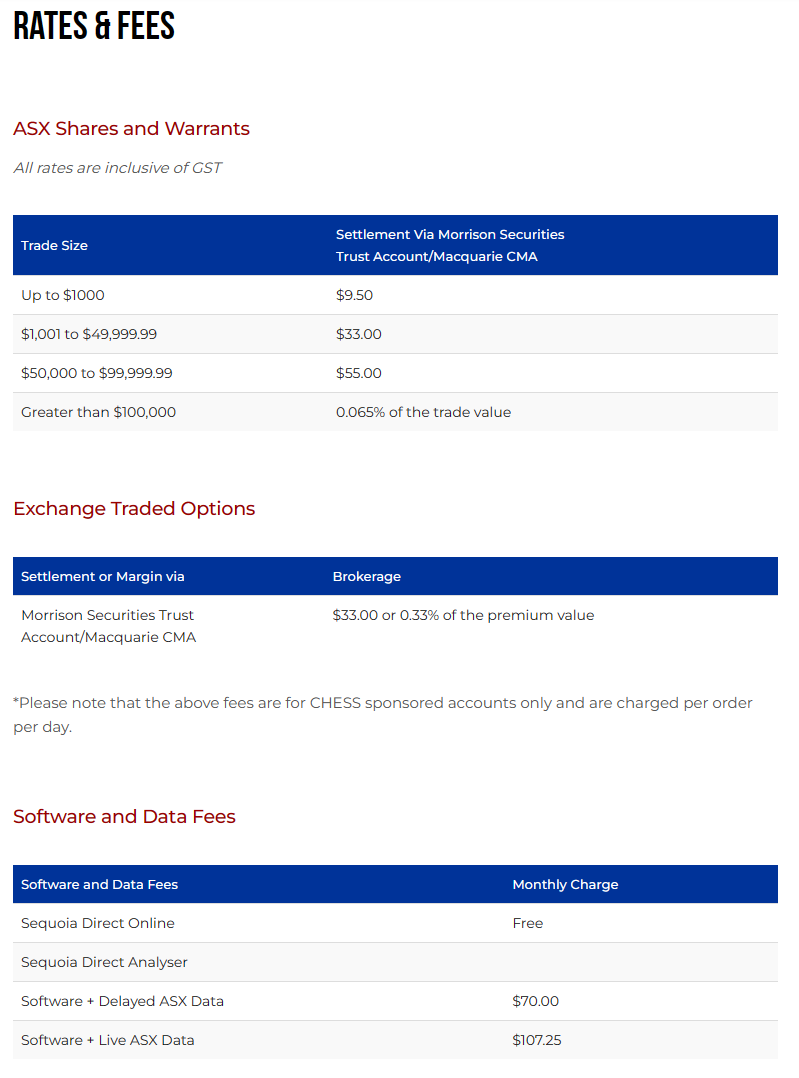

Sequoia Direct is another corporate authorised representative under Sequoia Asset Management’s license. SD is an online trading platform for self-directed investors wishing to buy or sell ASX equities, warrants and options. For a list of video tutorials, please refer to this link from the SD website. Pricing is as follows:

It is also worth noting, that for settlement of trades, SD uses the Morrison Securities clearing house, which we will detail at the end further below.

Acacia Administrative Services

Acacia Administrative Services Pty Ltd acts as a service entity for the Group with all employees engaged under this entity. Beyond this it does not constitute a trading entity. It would charge a recovery for labor provided to other subsidiaries of the group and shelter those other subsidiaries from professional negligence brought upon them. It is a common structure suggested by accountants and lawyers alike.

Sequoia Lending

Sequoia Lending, Unfortunately I could not find any details about, leading me to believe that this is likely to be a dormant entity within the group as a subsidiary of Sequoia Group Holdings.

Docscentre Legal & PantherCorp CST

This is where things get interesting (in my view). Docscentre is a legal structure platform for accountants, financial planners, SMSF administrators, law practices and associations. It ties in with Panthercorp & Constitute so we will talk about all of them here.

Previously I used to own a business called Class (ASX:CL1) which was acquired by Hub24 (ASX: HUB). During my tenure of ownership, they acquired a business called Nowinfinity. It is a truly excellent business and the most used legal document provider for SMSF compliance in the country.

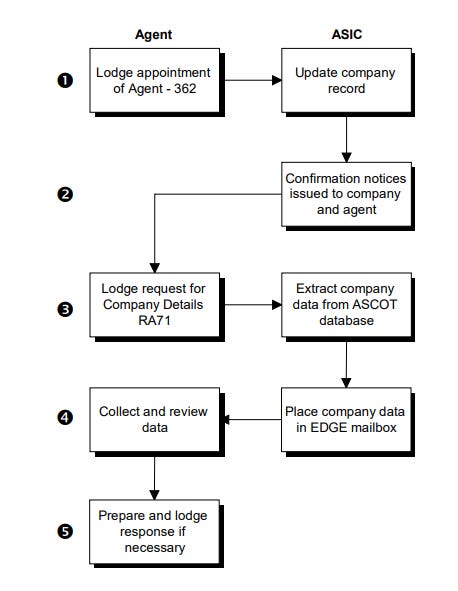

What enables this is EDGE/ECR, which is the ASIC API for large volume lodgers (such as accountants and legal firms). There is no fee to use ASIC’s EDGE API, but the use of the API is governed by terms and conditions including:

requirements to be an approved DSP (A person who has completed their application to access the ASIC Digital Services)

obligations of DSPs in relation to conduct (including marketing), use and security measures,

grounds on which ASIC may suspend or cancel access to ASIC digital services, and

expectations of DSPs in managing customer interactions.

The difference between ECR and EDGE is that ECR is part of EDGE and extends EDGE to include company registration documents (forms 201 and 410 for Australian companies).

Refer to this list of all ASIC Digital Service Providers (DSPs) that offer EDGE-compliant software. I count 44 DSPs on this list, which compares favorably to ~3.2m registered companies across the country, or some ~73k companies per DSP, each of these companies would need multiple if not dozens of document requests over its lifetime, meaning that DSPs are a CRUCIAL part of the Australian economy despite their rarity. To a smaller extent those that do not have a registered ASIC agent (usually tax agent) are required to access online information via. ASICs direct access to the EDGE API here. The usage is limited, and you can view and download your annual statements and some basic info etc.

Coming back to Sequoia, they own 3 businesses that all leverage off of this API, Panthercorp was acquired from Diverger (ASX:DVR) in 2020 for $1.7m, a $0.6m discount to what Diverger had it recorded on the books for. In the first year of ownership, it generated $0.6 in EBITA. It was deemed as non-core by Diverger (Easton at the time). Panthercorp is local to Perth in WA Australia as opposed to Docscentre being based in Melbourne which is in VIC Australia.

Docscentre (and constitute by extension) has access to both EDGE and ECR systems, making it a holistic offering, one of only 21 DSPs that have this, making it even rarer than the average DSP. It was also an acquired business in early 2022 for a total cost of $0.19m goodwill, which in of itself seems an optically low price, however, it contributed a $246k loss for the remainder of the 2022 year. They do state they expect it to be immediately earnings enhancing so I wonder if that was simply related to some adjustment required post-merger. Nevertheless, on an aggregate basis these businesses are extremely profitable with Panthercorp requiring little/no fixed asset investment, being working capital neutral and ~30% EBITA margins.

Tax Engine

Similar to Sequoia Lending, I couldn’t find much information on Tax Engine, only an existing corporate tax agent license where it says they provide BAS services and Superannuation services and could NOT find one for SMSF Engine Pty Ltd, so I daresay Tax engine is the nominated tax agent for preparing SMSF returns for SMSF engine. Made further believable by an initial ABN application for SMSF engine in December 2017 and Tax engine in February 2018. Lastly, the tax agent license registration date in early March 2018.

SMSF Engine

With this said, it seems like a good time to talk about SMSF engine. I like SMSF engine, it’s a similar business to Expert Super & Intello which I had covered in the Prime Financial Group (ASX:PFG) deep dive last month. Effectively, it provides an outsourced solution for accountants and financial planners to prepare the administration of the fund, either on an ongoing basis or just annual. The simple process is shown below.

So why don’t they do it themselves you may ask? Well, there is an overabundance of business entities relative to SMSF entities, and for this reason, most clients do not have an SMSF. For a firm to offer SMSF solutions, they also require a comprehensive understanding of the changing rules of super, which consists of a lot of CPD time maintaining that knowledge, which takes away from billable hours of the core and more importantly, without it there is significant key person risk. So often times it may be that if a firm were to offer these services, it would be detrimental to the firm margin or perhaps even a loss-maker.

Sequoia Superannuation (SSU)

Similar to SMSF Engine, SSU works with SMSF setup and administration, but seems to also bring into account a B2C offering. Confusingly, it also has a B2B offering. So again, this may well be similar to Prime Financial Group which has ExpertSuper and Intello doing similar things under different branding. Nonetheless, much of the above commentary on SMSF applies so I won’t go into the administration offer too much.

But where it differs is that SSU ties in with SAM, allowing SMSFs that are being administered by them to access their various service providers, however no investment products are ever sold by SSU to its trustees.

Australian Practical Superannuation Fund (Ausprac)

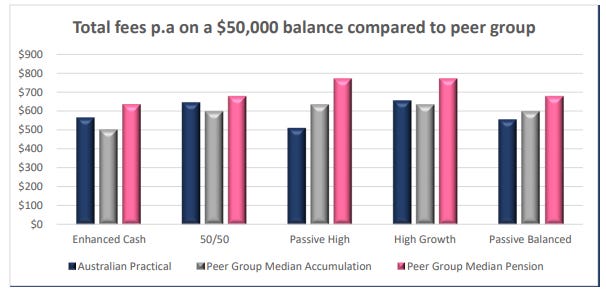

This business was acquired as part of the Yellow Brick Road wealth business, which was acquired in early 2020. It is an extremely small APRA super fund with just $175.6m in Net assets as of the end of 2019. Today that number is $98.7m. It has taken steps to reduce costs with a transition into Yoursuper in 2022, but the fund is so small I doubt this fund ever becomes something material to the Sequoia group.

The median account balance is $73,000 and the fees on that balance are $865 or 1.18%. If you take into account that is just shy of $98.7m, then Ausprac revenue would equate to $1.16m, however, as a sub-plan of another sub-plan the margin on that would be atrocious, so I daresay the Ausprac is an afterthought for Sequoia and the real value is in the 56 advisers brought into Interprac. Which makes sense as Ausprac isn’t mentioned once in the initial announcement.

Read more: Smaller is better says buyer of Bouris' $200m super fund (afr.com)

Interprac Financial Planning

Interprac is the entity that joined the group via. an acquisition in 2014 which was effectively a reverse merger. Interprac is the holder of an AFSL (AFSL 246638) for other entities which it acts as licensee for. Importantly, it offers a broad approved product list (APL) for its advisers and has ample scale to operate with profitable margins. It is highly reccomended that those interested read the Financial Services Guide (FSG) for more information.

In terms of it’s billing model, the business has a ‘preference’ for advisers to be paid on a ‘fee for services' basis. In some instances it will vary including insurance commissions paid to the licensee and then partially passed on to the adviser. Other fees that don’t get paid to the adviser, but the licensee receives include marketing fees for Ausprac marketing, cost reimbursement for adviser training, and referral fees paid from other professionals including accountants and solicitors.

Interprac Securities

Interprac Securities is one of several Corporate Authorised Representatives under the Interprac Financial Planning Australian Financial Services License. It consists of the salaried advisers under the group, which varies to the other authorised representatives where they do not own a controlling equity stake.

There are 7 employees under this entity consisting of 3 senior financial advisers, 1 client services manager, 3 client services officers, one of which also works as a paraplanning officer.

Libertas Financial Planning

Libertas was acquired in 2019 by Sequoia which brought in 70 authorised representatives (~24% of all Sequoia advisers currently) and was purchased for a total consideration of ~$2.4m where it contributed $0.6m to EBIT, a multiple of 4x.

More recently, Sequoia has been shifting advisers out of the Libertas AFSL onto Interprac in order to cut costs. I discussed this in my April 2023 Portfolio update. As of the 11th of May 2023, the finanical advisers register shows no leftover advisers in Libertas, meaning there is no reason they can’t cease the use of the AFSL and save costs.

Sage Capital Group

This company was acquired by InterPtac Financial Planning in 2009. Sage was a start-up investment management firm serving institutions, providing corporate advisory services to private and listed small and micro-cap companies. I can’t find much info about this entities current trading so I will go ahead and assume it’s dormant and it’s activities have assumed part of Sequoia Corporate Finance and Interprac alike.

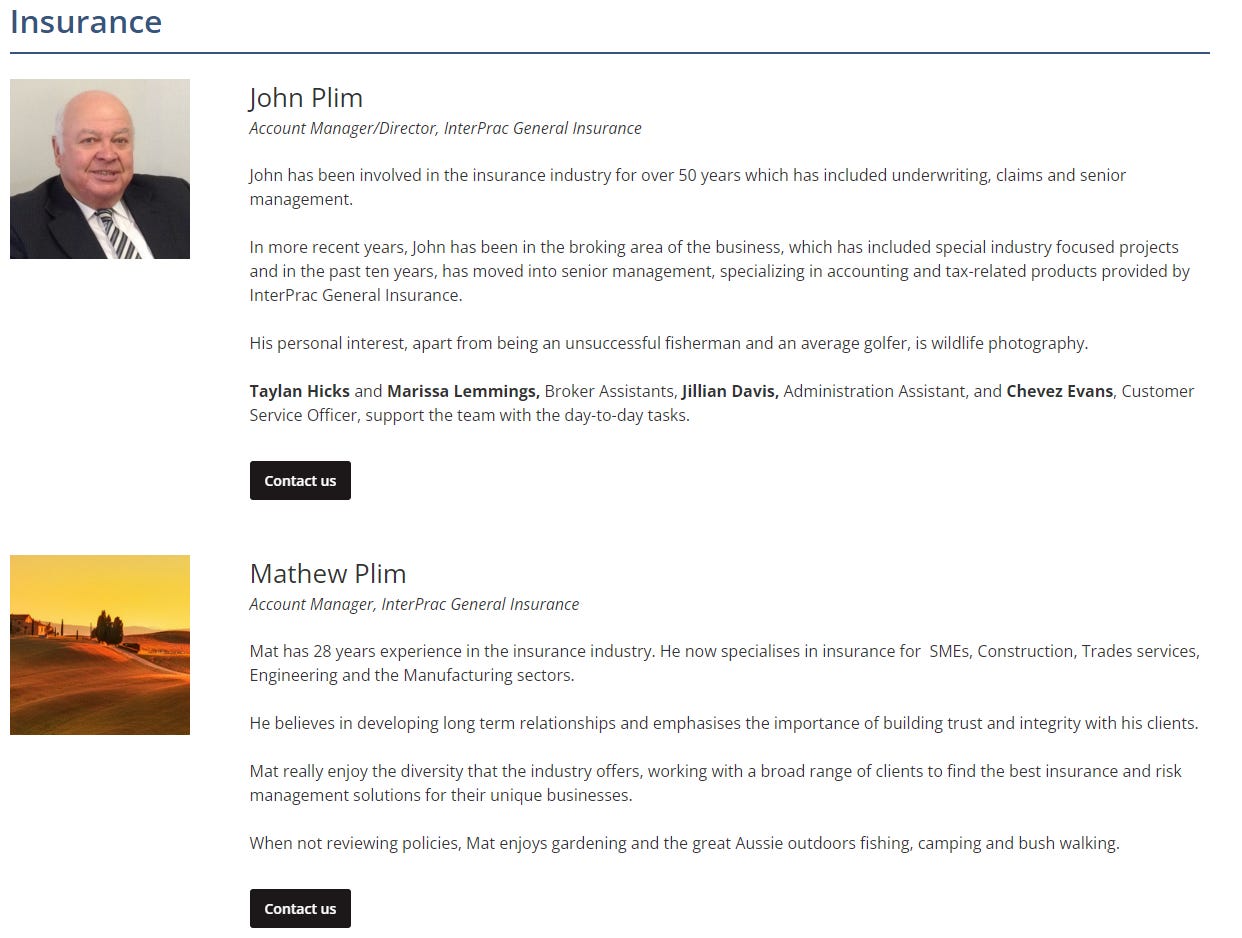

Interprac General Insurance

This is Interprac’s brokerage arm which specifically offers insurance broker services to Accountants. It operates as a corporate ruthorised representative under the PSC Connect license of PSC Insurance (ASX:PSI). John Plim is the principal of this business.

Importantly, this business benefits from a strong relationship with the National Tax & Accountant’s Association (NTAA). It has been one of 2 preferred providers of accountant’s insurance to NTAA members across Australia for over 20 years. To put that in context, the NTAA is by far the largest body for Accountant’s in the country with over 10,000 member firms or some 30% of the market.

Example policies that Interprac general insurance provides is the compulsory PI insurance for Tax and BAS agents along with office insurance, management insurance, cyber insurance and can even look-through to providing some select insurance for clients of firms.

The billing model for the insurance business is one of a revenue share. First, the underlying insurance company will charge a premium based on underwriting. The AFSL (PSC Connect) often receives payment based on a percentage of this premium (typically between 10-30%), to which then the authorised representatives earn a percentage of this commission (typically 10-20%). As to the timing of cash, most brokers don’t receive any payments until after a policy is placed and the commission is received from the insurer.

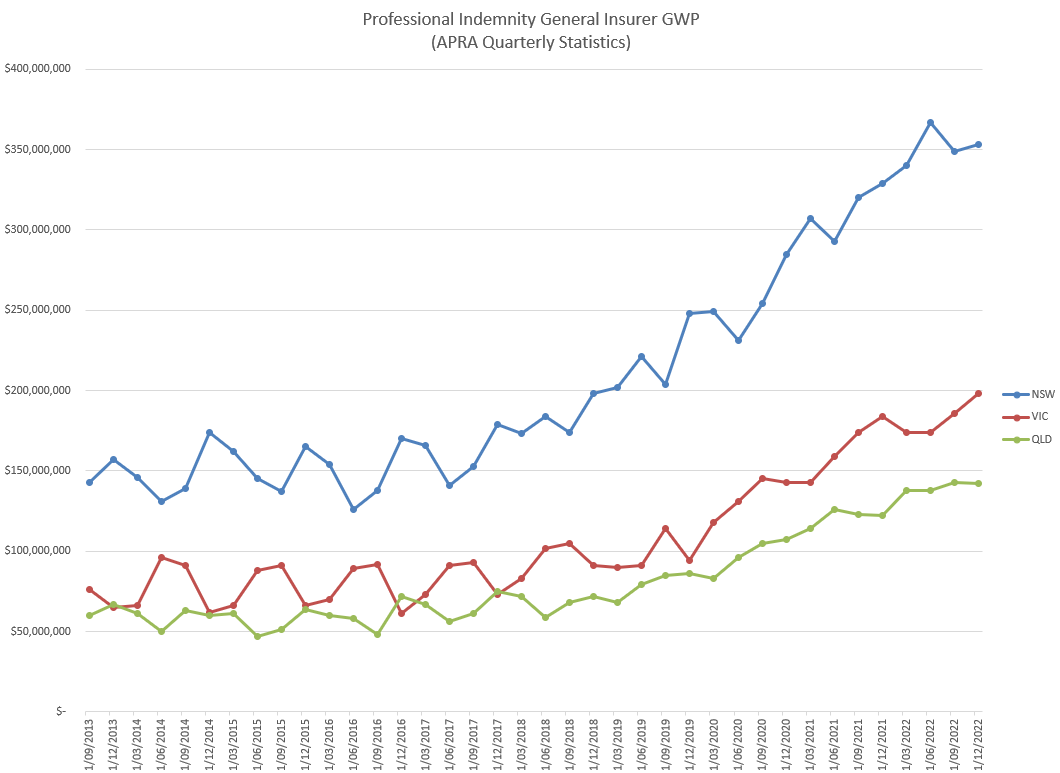

The growth of PI premiums over the preceding decade has been substantial, across the 3 major states (NSW, VIC & QLD account for over 85% of all tax agents - per the TPB 2022 Annual Report). Particularly in the past 5 years premiums have more than doubled across all states with no signs of slowing down with PI premiums just recently being raised in excess of 20% on the year by most insurers.

Sequoia Corporate Finance

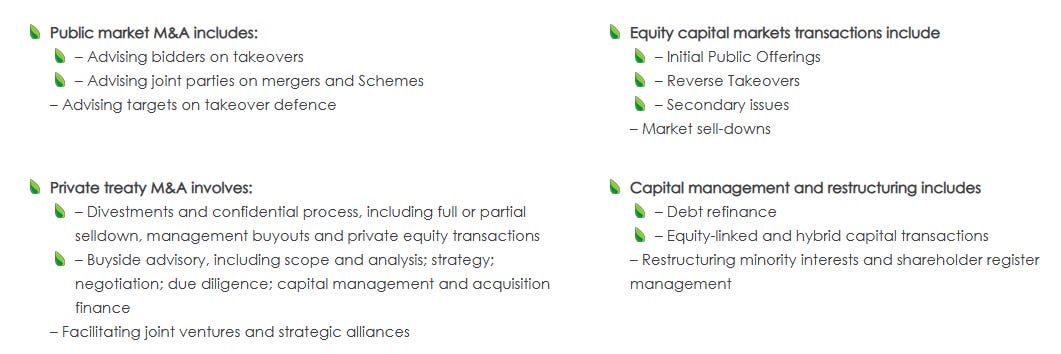

Sequoia Corporate Finance provides services including the following:

In recent times, it assisted with the listing of SOCO (ASX:SOC) and Chilwa Minerals (ASX:CHW). Remuneration paid to Sequoia Corporate Finance can easily be found within each prospectus respectively. I spoke about this in the April 2023 Portfolio update as well so I would point you towards that.

Sequoia Wealth Management

Sequoia Wealth Management seems to be the distribution related entity for all the products within the group. They provide general and personalised advice for client of advisers and direct clients alike. To learn more, refer to the website.

Sharecafe, Finance News Network, Informed Investor & Corporate Connect Research

These businesses have been combined as the informed investor newrok as they were acquired as one deal in March 2022 (except Finance News Network). They paid a total consideration of $5.1m. of which some 40% was deferred subject to performance hurdles. As of 31 December 2022, none of this was written down so I assume these hurdles are to be met at this stage.

Notably, this acquisition has been a major dissapointment for the Sequoia management team with the following commentary provided in the half year results.

1HFY23 compared to 1HFY22

Revenue $1.8M up from $1.0M

Gross Profit $1.1M up from $0.7M

Normalised EBITDA $0.1M down from $0.4M

In terms of other abnormal matters, the acquisitions recently made within our Direct Investment Division have taken longer than anticipated to integrate into our broader business model. Normalised EBITDA for the Direct Investment Division was $0.3M below the corresponding period last year, compared to our budget expecting an increase of $0.7M normalised EBITDA for 1HFY23. This division remains a key focus for our executive team in the coming period and we are expecting an improvement in the performance of this division.

The initial integration and investment spend on systems, websites, and changes in personnel across the media, research, education and portfolio management businesses is now expected to deliver improved results. The appointment of Winston Sammut and additional research analysts is expected to have a meaningful impact in the coming months. This will assist the Division in meeting its target of at least $0.5M monthly revenue, and normalised EBITDA above $0.1M per month over the next 6-12 months.

Frankly, I am not a fan of the Direct division, but nevertheless, if they can turn this around as a positive contributor that would be great, otherwise I would be happy if they divested it.

Nevertheless, the business operates under a few different brands:

Informed Investor - Informed Investor works with licensees to create a digital version of their Approved Product Lists. There is a few explanatory videos found here. These digital profiles can be linked directly into recommendations made in an SoA for advisers. Furthermore, some products also offer CPD for advisers as subscribers to Informed investor.

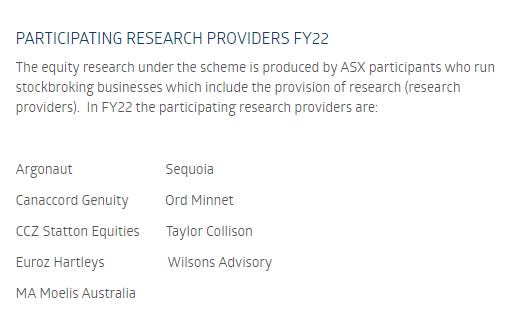

Corporate Connect - Partners with listed companies to grow their investor base through industry-leading research. It provides analyst coverage which is distributed across its various news sites and rest of the business, including most of the above-mentioned subsidiaries.

ShareCafe - This is a 25-year-old financial news website with frequent articles written by their long list of contributors along with reports and videos from those companies paying Corporate Connect.

Finance News network - I find this as synonymous with ShareCafe but here’s their marketing video.

All-in-all, the direct division is not something I’m particularly excited about, but nonetheless, it does give them a broad reach. I will consider it as optionality beyond the other divisions if it works out.

Bourse Data

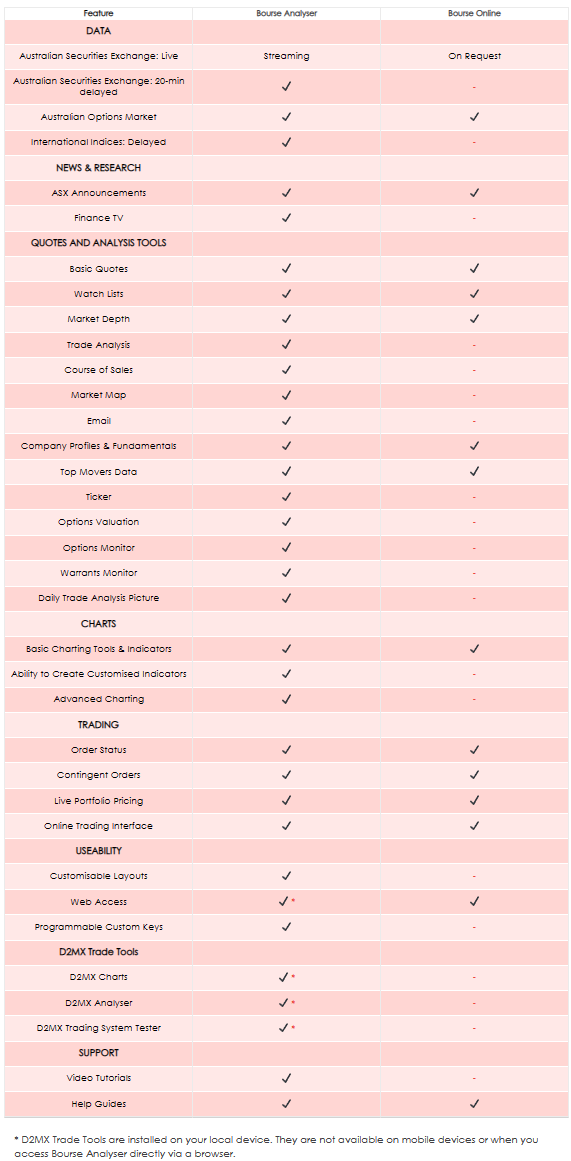

Bourse Data is one of Australia’s leading stock market software for charting and technical analysis. It offers 2 main products, Bourse Analyser and Online. Bourse Online is free for investors, whereas Bourse Analyser is $70 per month with extra for various add-ons, but FREE for Sequoia Direct accounts. A full feature comparison is shown below.

Sequoia Premium Funding

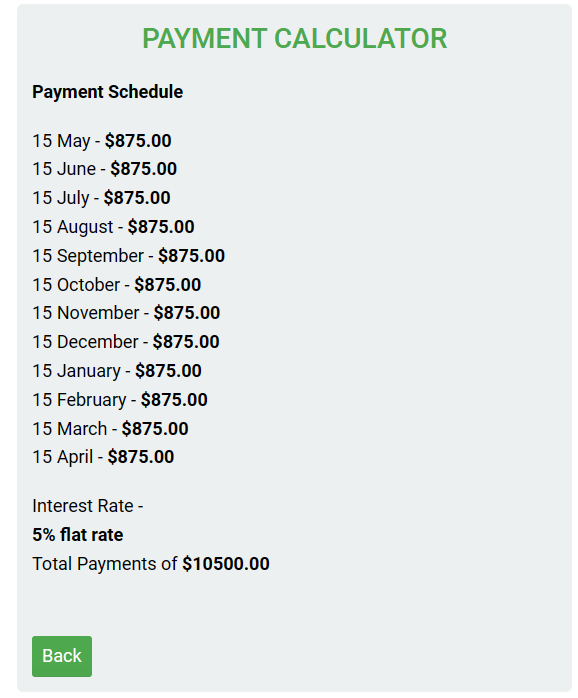

This business offers financing for insurance premium payments, which splits it into monthly repayments. It offers this service for Professional indemnity, Workers’ compensation & Public Liability. This is a pretty simple business model, and no ongoing fees or charges are made for the loan term of 6-12 months. Currently the interest rate is 5% fixed as shown via the calculator on their website.

One thing to note is that this entities AFSL was cancelled in November 2021 and the AFSL is now held in the Sequoia Insurance Brokers Pty Ltd entity. Other than that, there seems to be no change.

Morrison Securities

Onto the elephant in the room. For context, Morrison Securities was acquired by the group for ~$3.6m in September 2017. Just 5-6 years later they are selling it for a valuation of $50m (on a 100% basis), not including all of the earnings made from it in between and paid up to the parent. An exemplary outcome.

The business is a white label trading solution provider to Broker Dealers where they provide wholesale stock broking to AFSL holders such as financial planners, banks and trading educators.

In the period of ownership, the business has grown its distribution extremely fast, with revenue growing from $1.25m in FY18 to a forecasted $30m in FY24 moving from a small loss to a ~$2-3m EBITDA profit.

Given that this business is going to be a small part of the business going forward it doesn’t make too much sense to focus on it. But the deal itself is worthy of diving into. You should read the initial announcement and the subsequent announcement. Furthermore, there is an exclusive discussion with Garry on ShareCafe as well.

The market has concerns about the purchaser’s propensity to pay with New Quantum best known locally for trying to buy Openmarkets last year, in a deal that was understood to have failed amid concerns around the acquirer’s funding capability. However, in this case both Garry and New Quantum CEO have encourages that this will occur.

Nevertheless, there is a failure fee of $3m-$7m due to Sequoia in that event, 6-12 months of group earnings, and they retain ownership in Morrissons. I was confident of their value prior to the deal being announced, so when I saw this I was ecstatic.

Outlook and Valuation

The future outlook of the business in the companies view, is to maintain their stated growth strategy as shown below, with an adjustment required for the sale of Morrisons, likely to be conveyed in August as they release their results and receive final payment in relation to the deal.

My belief is that most of the businesses will experience organic growth in their end markets, increased market share through acquisition or pricing growth.

If there is one thing, I’ve learned it’s that Sequoia has a lot of businesses doing similar things that I feel like they could consolidate into the single business. Take for example, Sharecafe and FNN are basically the same thing, but were their own things prior to the deal so they have brand value that makes having them separate valuable, but they are the same thing, nevertheless. Another thing which is being actioned is Libertas merging into Interprac. Docscentre, Constitute and Panthercorp all leverage off the one Edge API owned by Docscentre and do the same thing, I don’t think any particular one has brand power so why not consolidate them? In any case, it’s a highly diverse collection of businesses and seems that the trend will only continue.

Nevertheless, at a market valuation of $82.5m ($0.60 per share) as at 15th of May 2023, and a likely $40m in cash on the balance sheet post deal along with a $10m EBITDA post deal, I will let readers make their own deductions as to whether Sequoia is priced fairly or not.

Thank you all for reading, let me know below if you liked this deep dive as a comprehensive overview of Sequoia’s subsidiaries to get a proper understanding of the business activities.

I leave you with Garry (CEO), surrounded by women.

One other comment - and if there is an easier way to provide feedback, let me know - but I think it would be super helpful to get broader company overview of the company’s history and context. For example, you wrote that EPS was >30% cagr but TSR <10%. What’s going on there? Skepticism on extensive M&A? Distrust of mgmt? Extremely rich starting valuation? Increased leverage? Always hard to truly pinpoint market concerns but given how well you know the company, that would be interesting to get your views on.

https://cdn-api.markitdigital.com/apiman-gateway/ASX/asx-research/1.0/file/2924-02685696-2A1460679?access_token=83ff96335c2d45a094df02a206a39ff4