Dear Subscribers,

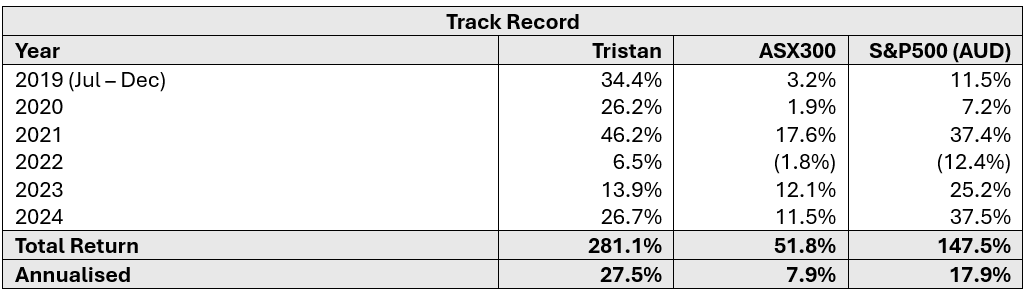

With the new year dawned on us I wanted to reflect on my track record to date. Detailing some of the key contributors and changes of process for each year.

2019

In mid-2019 I start writing stock pitches, with the events before this being largely contained to index funds and blue chips. In the following 6 months I wrote 23 stock pitches! One every 9 days. I believe that writing has been the single biggest positive contributor to my development as an investor.

The below shows the individual contributors to the result, weighted by dollar returns.

Of those stocks I chose in that half year period, all of them were profitable. My favourite thesis of which was Yowie, an Australian chocolate manufacturer trading at a deep discount to net cash (cash - total liabilities). The best performer by far was SMSF software business Class, a program I was using as an accountant at the time.

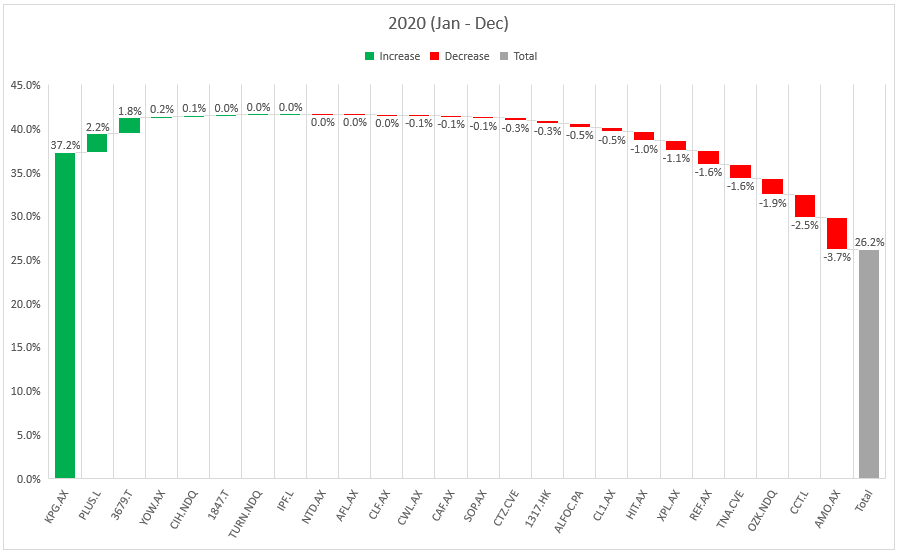

2020

In March of 2020 I decided to create a discretionary trust for myself and my girlfriend (now wife). This was seeded with all of the capital in my personal account and her funds, marking my first foray into managing money for others.

With this, I changed my process to that of a ‘Coffee Can’ (note, performance figures have been recalculated properly so will differ) type of investor. I would save up a predetermined amount of money and then purchase a single stock. I did this 5 times over before moving on from this approach in late 2022.

This might sound timely, given that it aligns with the deepest drawdown of the COVID crash, but I assure you that I liquidated just after the largest of the drawdown, and only started repurchasing in the new trust in late April, meaning I took the full negative impact and missed some of the rebound.

Perhaps one of the craziest charts you will see on this post, you can start to see the dominance of Kelly Partners (linked post has a list of all posts) with a fairly long list of negative contributors, which are predominately due to those being liquidated in the March drawdown. In the remaining 7 months of the year I only held 2 stocks for the majority of the time, including Kelly Partners.

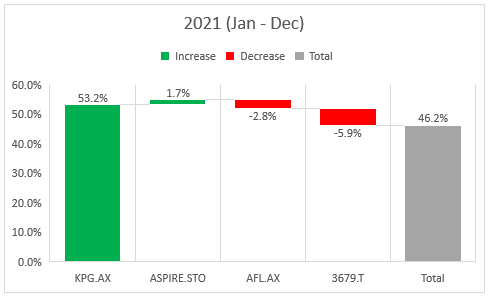

2021

2021 was extremely low activity with not a single sale trade during the year, yet turned out to be my best year yet. A single investment into Aspire Global was made in October 2021.

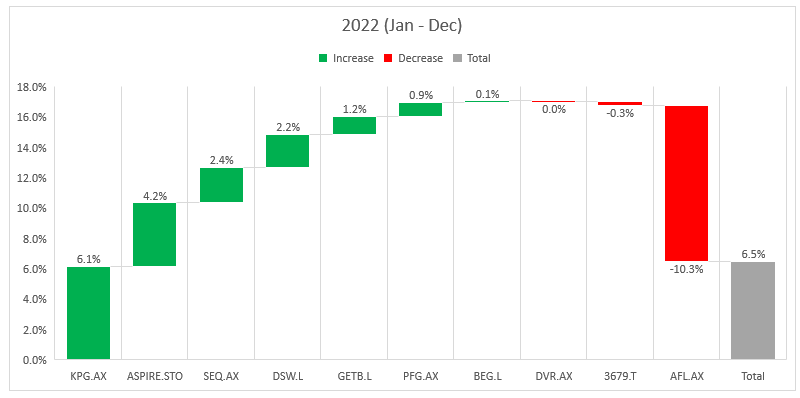

2022

2022 was a year in which I decided to diversify some more after experiencing a negative experience with AF Legal which resulted in management being replaced and a cratering of the stock price. However, despite this, all other positions for the most part picked up the bill by performing well in advance of this, to give the trust a positive return in a year where indices declined.

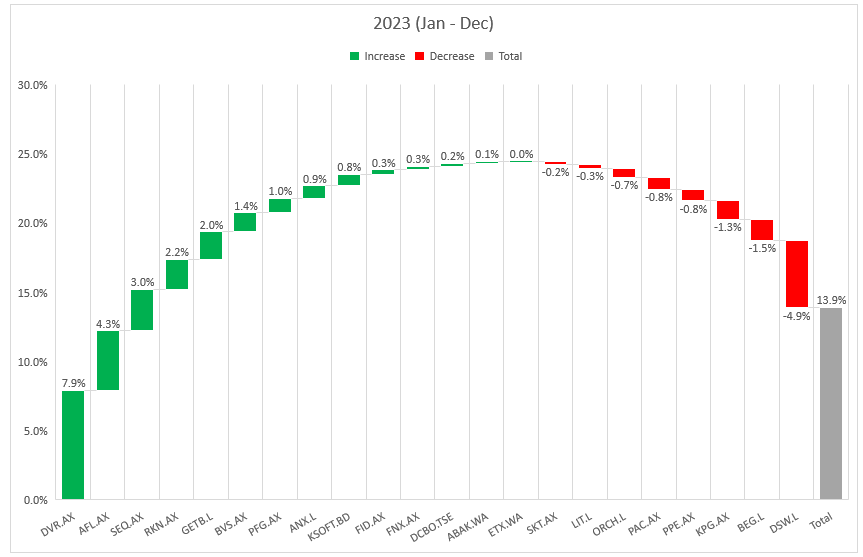

2023

2023 marks the launch of the Hurdle Rate Unit Trust (in April 2023), an investment vehicle for family and friends. In a similar fashion to 2020 there was a small period in which I was out of markets whilst I transferred to the new trust.

Nevertheless, performance was decent, with Diverger receiving a takeover bid from Count being the star of the year. AF Legal also begun to show signs of a turnaround with improved financial results following the appointment of Chris McFadden and Peter Johns. DSW Capital had a weak year following a strong one, with M&A activity in the UK falling off a cliff, showcasing their small but albeit fixed cost base

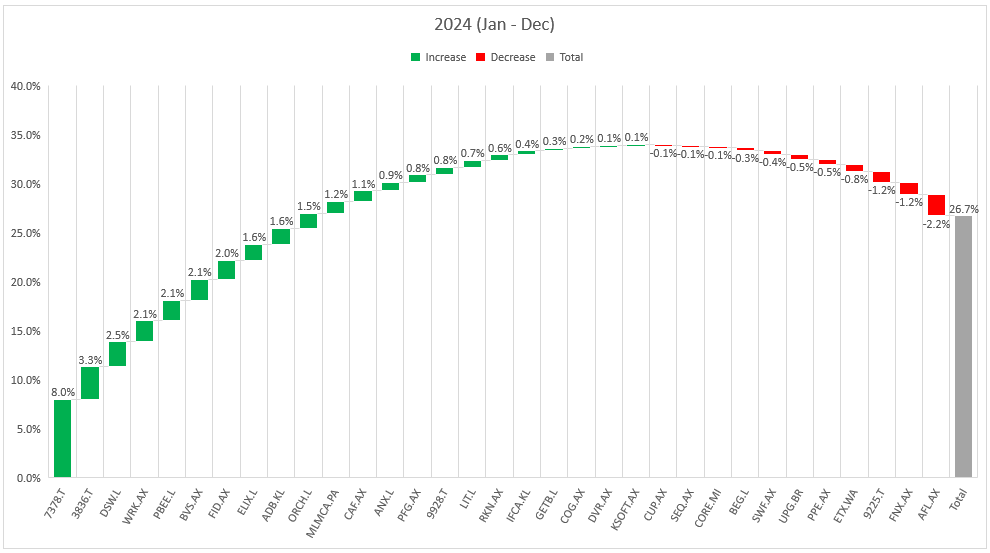

2024

I am very proud of my actions during 2024, with a much broader and consistent set of contributors with limited losses. The clear standout was Asiro which saw a substantial return due to consistently outperforming guidance and upgrading future guidance. AF Legal contracted slightly due to a loss of business momentum in the 1st half, which could be remedied following recent acquisitions. Other significant wins include Avant, Wrkr, PensionBee, and Bravura amongst others.

Concluding thoughts

I wanted to provide a quick overview of my history of an investor. Whilst it is clear that I generated a lot of my returns from Kelly Partners in particular, I have consistently applied curiosity into writing about many different companies and seek to continue this into the future.

Thank you for reading.

Tristan

Doing well while doing good. Impressive results my friend

Congratulations on the great results, Tristan.